Table of Content

Churchill is a well-known UK brand and it’s well trusted by its customers, as shown by its excellent rating on Trustpilot. It’s also ranked 174 out of 255 companies on the ratings website out of all companies defined as insurance agencies. On Trustpilot, Churchill gets a score of 4.4 out of 5 stars and an average rating of ‘excellent’. There are 4,232 reviews from customers and of those 70% are excellent, 14% are great, 2% are average, 2% poor, and 12% bad. DoNotPay will work on cancelling your insurance and notify you once it's been cancelled.

For an extra cost you can add legal protection for you and your family of up to £100,000. This includes cover for things like personal injury and clinical negligence, employment disputes, motoring prosecutions, and inheritance disputes. Thank you for spending a few minutes to visit our website today.

Churchill home insurance

However, you should understand your options before committing to any plan. Churchill Car Insurance is a multi-car insurance policy that offers a discount for insuring up to ten vehicles. With this policy, you can keep a different renewal date for each vehicle, add additional family members and even have a no-claim discount on a second vehicle. Many optional extras are available for a Churchill Home Insurance policy, including Accidental Damage cover. Additionally, Churchill Home Insurance is considered a top-notch provider by Defaqto, having received full five stars for buildings and contents insurance. It has also received less than 30 formal complaints from the Financial Ombudsman.

In addition, you can also manage your Churchill Home Insurance policy online. Churchill Home Insurance is a 5-star rated insurance company. Their policies are very comprehensive and come with a range of optional extras.

Take a look at our optional extras

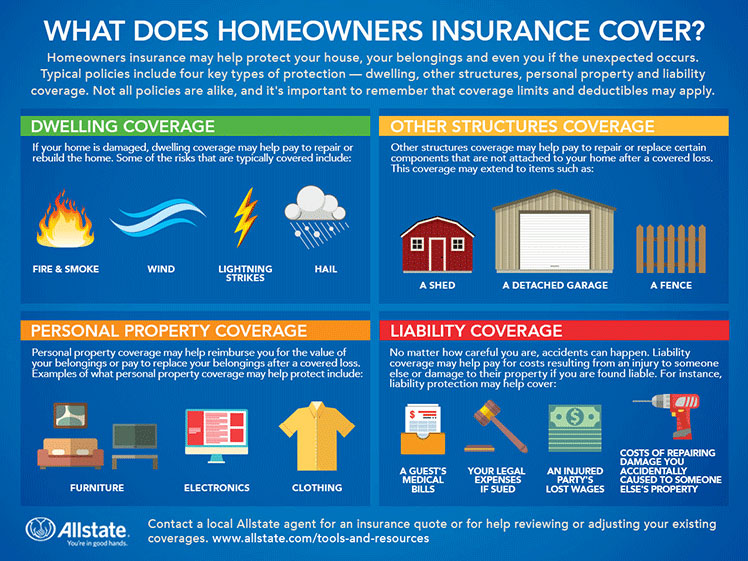

But, if you had a fire in your bedroom that ruined your clothes and your bedroom furniture—that’s where homeowner’s insurance would come into play. This includes all the features of our regular Home Insurance with extras included, such as cover for accidental damage. Churchill offers Buildings insurance, Contents insurance and Buildings and Contents insurance combined.

Accidental damage insurance protects against the costs of repairing or replacing something that's been damaged or destroyed in an accident. Not all policies and types are available through our site, so the exact levels of cover and benefits may vary. Before buying home insurance, we recommend you check the cover and benefits included. If your home isn’t safe to live in after an event like a fire or flood, you’ll get the cost of alternative accommodation covered . You might also be offered emergency funds, to cover immediate essentials, like food and clothing.

About Churchill home insurance

It’s also a good idea to look at social media feeds as they are a quick way to see how companies deal with customers and also to find out what people think of them. You can also get a multi-car discount with Churchill Home Insurance. This discount is valuable for people who drive a lot and have multiple cars. Churchill Home Insurance covers underground damage, emergency accommodation, and replacement locks.

The company is a member of the Direct Line Group and is traded on the London Stock Exchange. They’ll also cover your salary while on jury service up to £100,000. Family legal protection also covers everyone in your family, provided they live with you. It even covers personal injuries that happen outside of the UK. Although not a legal requirement, it's worth considering leasehold buildings insurance to cover damages to the building.

Following the bailout of RBS by the Government of the United Kingdom in 2008, the European Union demanded that certain group assets be sold off, including the insurance division. In February 2012, Churchill became part of the new Direct Line Group, which was created ahead of a divestment that was completed in February 2014. The ad has been controversial and has recently attracted more than one hundred complaints. However, the Advertising Standards Authority has not taken any action, indicating that the ad is not violating any rules. While the ad has prompted a lot of conversation, it is unlikely to affect the company’s business in the long run.

Your items are also covered for up to 60 days when you are out of the UK, such as when you’re on holiday, and up to £500 in cash is included. If you buy buildings insurance, you’ll be protecting the structure of your home - the bricks and mortar and anything attached to it such as the kitchen sink or your bath. It’s usually required by a mortgage provider and most people who own their own homes will have a policy. Suppose you cancel your Churchill insurance policy during or after your 14-day cooling-off period. O break it down even further, if a hurricane or tornado damaged your home, hazard insurance would help pay for the cost to repair or rebuild your house.

Churchill offers two types of accidental damage cover that you can add to your home insurance policy for an additional premium. It has been selling home insurance policies since 1990 and it also sells a wide range of general insurance products. This critical illness plan can help you secure savings if you contract certain illnesses. It covers a range of conditions, including heart disease, stroke, and certain types of cancer.

It’s important to note that not all insurance policies are the same. Talk to your insurance agent about what may or may not be covered with your homeowner’s insurance. Churchill Home Insurance has partnered with AIG to offer a critical illness plan.